Peter Nolan on the Economy

Barry, the Ambassador of JOY, invites Peter Nolan one of America’s leading businessmen to discuss: SOB: State Of Business. Get ready for inside information on where we’re going. Peter founded Nolan Capital, Inc. for his family office to make long term investments in growth-oriented companies. Peter is Senior Advisor to Leonard Green & Partners (“LGP”) with over $40 billion in assets. Peter also acted as advisor to entities such as adidas AG, the Government of Mexico, Saatchi & Saatchi PLC, Televisa S.A., Metromedia and Orion Pictures. Peter presently serves as Chairman for Diamond Wipes, Fresh Brothers, and Ortega National Parks. He currently serves on the Board of Directors of Activision, Inc. and AerSale Holdings, Inc. Peter serves as a trustee of the United States Olympic and Paralympic Foundation.

Listen to the podcast here:

Show Notes:

- 00:45 – Barry’s rousing introduction

- 14:17 – Peter Nolan on the Economy

- 24:40 – It’s a gateway tax. In many ways, it’s brilliant politically. Let’s tax Elon Musk and Jeff Bezos because they’re ungodly rich.

- 41:55 – Remember, that’s one of the four horsemen, inflation, deflation, confiscation.

- 52:21- Barry’s Interesting Wrap-up

Important Links:

- https://www.linkedin.com/in/peter-nolan-89729814/

- http://www.nolancap.com/

Good day, Beautiful, Bountiful, Beloved Immortal Beings and Good-Looking people. Remember you’re Good-Looking because you’re always looking for and finding the Good. We have good in abundance, overflowing. Because you have tuned in consciously and conscientiously to this show, The Joy of Living.

You are going to be amazed at what’s going to happen for you. You tuned in to the show because you care most in the entire world about YOU. That’s great. Because when you become the best possible YOU, you make the world a better place. You build bridges of harmony. You create more Joy, Happiness, Peace, and Love in the world. That’s why you’re here.

You know that on this show we speak about the Three fundamentals of life.

These fundamentals are: Number One… your life has a purpose.

Number Two, when you lead a purpose-driven life, you can go MAD. In this case, MAD is a wonderful acronym that stands for Make A Difference. You lead a purpose-driven life. You make a difference.

Number Three is to unlock the secrets and the power of everyday words and terms. Here’s a simple example. Right now, we’re being carried all over the world. There are, at this moment, over 349,617 people reading and listening via this fantastic, amazing mythical mystical platform called the Internet.

If you ask anybody, what does WWW stand for? They’ll tell you it has to do with the internet. And factually speaking they’re correct. But in our world, the world of the Positive, Purposeful, Powerful and Pleasant, WWW stands for Whata Wonderful World and Whata is a word. Thank you to Louis Armstrong, Satchmo, for enabling that song to go viral and touch not tens of millions or hundreds of millions BUT billions of people around the planet.

The purpose of this is that you tuned in to the JOY of LIVING because you know in this show, the result of you listening to the transformative advice that’s being SHARED with you from our amazing guests is that you will be Happier, Healthier, and Wealthier. And Who doesn’t want that?

That’s why you tuned in to the JOY of LIVING! Everything you want to know about our Amazing guest you can find at www.BarryShore.com. You don’t have to write anything down

Just go to BarryShore.com. All the information will be there. So lean in, and let all of this beautiful transformative information flows through, around and in you. And please SHARE this with at least FIVE people. Then we will touch over a million and a half people sharing these great, wonderful ideas.

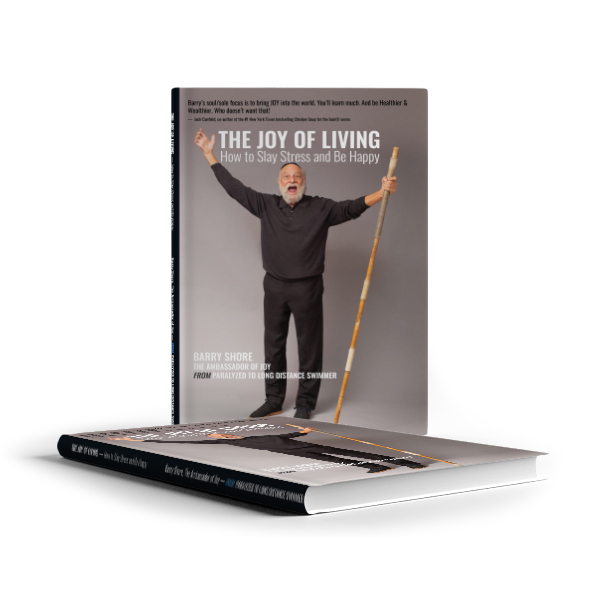

Remember, all of this happens because of one word. Let’s talk about the story. Imagine the following. Standing up in the morning, hale and hearty, able to leap tall buildings and that evening be in the hospital completely and totally paralyzed.

That’s the story of Barry Shore.

Imagine that. Standing up in the morning perfectly healthy and in the evening, being completely, totally paralyzed. I became a quadriplegic overnight. It was not from a car accident or a spinal injury. It was a rare disease which I never heard of the day before. And now I’m completely, totally paralyzed.

I was 144 days in the hospital.

I was in a hospital bed in my own home for two years and couldn’t turn over by myself.

I was in a wheelchair for four years. I had braces on both my legs, from my hips to my ankles for years. And that was progress.

Thank God now I’m able to be vertical and ambulatory with the help of a 7-foot walking wand made for me by a Zen master.

But I still can’t walk up a stair by myself. I can’t walk up a curb by myself. And I have help 12 hours a day, 7 days a week.

But you hear my voice. Positive, Purposeful, Powerful and Pleasant.

And it’s all because of one word. That word is SMILE. Yes, S-M-I-L-E. It’s an acronym.

Remember, we unlock the power and the secrets of everyday words and terms. SMILE is an acronym that stands for Seeing Miracles In Life Every day.

Recently I was speaking to an audience of about 5,000 plus people and, God willing, we will be able to do that again very soon. We’ll go back and talk to real people. I tell the story of Barry Shore. I tell about SMILE and people raise their hands and say, “Barry Shore, I’ve been up for hours. I haven’t seen any miracles.” I ask them, “Are you here? Can you hear? Can you see, stand, walk, have water to drink, food to eat, a place to sleep, family, friends? Every single one of those is a Miracle.”

What’s a simple proof? Simple proof. One million people didn’t get out of bed this morning. Do you know why? They died! By definition, if you’re listening or watching this you didn’t. Therefore, you have an obligation to celebrate life to the full.

Heres’ a quick story. A few weeks ago, my 8-year-old niece comes over to me and asks, “Uncle Barry, can we spell smile, S-M-I-E-L?” I thought about it. It sounds the same. Why not. I asked her how come. She says, “Because then it will stand for Seeing Miracles In Everyday Life”! Out of the mouth of babes. What was she doing? She was creating the kind of world she wants to live in. CREATE is a wonderful acronym that stands for Causing Rethinking Enabling All To Excel. Because it’s all here in your mind. It’s called Neuro-Linguistic Programming. NLP. Your brain has 100 billion brain cells and over 100 trillion synapses connecting these cells and they’re there for more than deciding what kind of latte you want this morning.

You can become that which you want to be. The world needs you to be your BEST you.

I do have to warn you in advance that your humble host does use a lot of four-letter words. I even use the four-letter FU word, and I do it because of the shock value and because it’s Fun. Now the four-letter words that we use, because we live in a world that’s Positive, Purposeful, Powerful, and Pleasant…these Four-Letter Words are: Love, Hope, Grow, Free, Gift, Pray, Play, Swim. Four-letter words.

And the four-letter FU word is…. “FUNN”. Right away, people are saying, “Barry Shore, fun is spelled with three letters.” Not in our world. In the world of Positive, Purposeful, Powerful, and Pleasant it’s FU—Capital N, Capital N!

So, after the show, when you see your family and friends, have a smile on your face and a twinkle in your eye. You point your finger and say, “F-U everybody.” Remember to add right away Capital N Capital N. And they’ll say, “What are you talking about? Where’d you get that?” You say, “I listen to Barry Shore, on The Joy of Living, and he wants to teach the world to FU…Capital N-Capital N.”

Before we bring on our amazing guest, and it’s truly going to be a FUNN session, I’m going to urge everybody to do the following. I want you to use the Two Most Powerful Words in the English language Three times a day from now and the rest of your life. When you use these Two most powerful words in the English language, you’re going to Make A Difference for you, your family, your friends, and all living beings.

These two words are……… “Thank You.”

THANK stands for To Harmonize And Network Kindness. The Dalai Lama has been quoted as saying and I’ve read in his writings, “Be kind whenever possible. And it’s always possible” he says.

Imagine you’re going into your coffee shop, and you order your fancy latte. You go in, you order and you sit down. Somebody brings it to you, you say, “Thank You.” Now imagine you go into the coffee shop. You order your fancy latte. You sit down. A few minutes go by and nobody brings it to you. You go to the counter, and they say, “I’m sorry, we’re busy. We’ll bring it to you.” You sit down and a few more minutes go by. Someone brings it you, you still say, “Thank You.”

Imagine, you’re walking out of the coffee shop and it’s raining out. Somebody holds the door open for you, you say, “Thank You.” You are walking out of the coffee shop. It’s raining out. Somebody slams the door on you! You say, “Thank You.” You’re in traffic. You’re late for an appointment. Somebody cuts you off, you say, “Thank You.” You get up in the middle of the night, you stub your toe and it hurts! You say, “Thank You.”

To Harmonize And Network Kindness. KIND stands for Keep Inspiring Noble Deeds.

Peter Nolan:

Thanks, Barry.

Barry Shore:

Peter, say hello to 358,000 people around the world.

Peter Nolan:

Hello to 358, probably now it’s 357. They know I’m on.

Barry Shore:

He has a deprecating self-sense of humor. And it’s one of the reasons I love him. This is the third or fourth time Peter has been on the show, and every time we have a lot of comments because Peter is privy to information that very few people have, and for great reason. It’s not because he’s a member of The Bilderbergers, whatever that’s called, he’s not a Rothschild. And he’s not even part of the Biden administration or Trump. He is a hardworking, dedicated public servant working in private equity, which means he’s a capitalist through and through in the most positive sense because he’s here to build wealth for everybody that’s involved who works with him. I want to make mention of three important aspects of Peter. Number one, he runs his own family office as well, which means he invests his own hard-earned money in businesses for long-term investment. This is very important. He’s not just helping other people place their bets and do things, he puts his own money up in large numbers. That’s number one. Number two, he gained this experience over 35 plus years as a managing partner, and now a senior advisor to a group called Leonard Green Partners, which has raised over $50 billion in assets since its inception. So you’re dealing with large sums of money from major places, sovereign wealth funds, institutional investors, etc. So you better be, not just good, but great at what you do. And number three, in my humble opinion, most important, Peter is a husband, a father, a former Eagle Scout, a friend, and a great guy, and in this particular circumstance, a concerned citizen. And that’s why I’ve asked him to come and speak to us about what I call, do you remember the 1970s. And I’m not talking about bell-bottoms, or John Travolta, or disco dancing, we’re talking about what I call the Four Horsemen of the economic apocalypse. So those who know anything about the Bible, the four horsemen of the apocalypse are conquest, war, famine, and death. Not what you call every day, around the table, family discussion. The four horsemen of the apocalypse, economically speaking are inflation, deflation, confiscation, and devastation. We may be in the beginning stages of large inflation. And inflation is one of the four horsemen of the apocalypse. We’re very au courant, Peter, because just a couple of days ago, Jack Dorsey, the founder, and CEO of Twitter, which has hundreds of millions of people that access his company and listen to his voice to some extent, made a pronouncement that Hyperinflation is here, and you better watch out everybody because it’s going to be an economic ruin. So I just want to have us jump right in, and have Barry Shore speak less, listen more, and ask Peter. You know what’s happening in the world. Talk to us about inflation, and what you see beginning to happen in our country vis-à-vis economic supply of money, etc.

Peter Nolan:

Thanks, Barry. I think to directly answer your question, it’s a little bit like the Coronavirus. Remember when it all started they said to put a mask on for two weeks and it’ll be over and then it was put a mask on because our hospitals are becoming overwhelmed. And now we’re in the never-ending put a mask on. It’s funny, I happen to go to the Rams football game in LA yesterday. For those of you that haven’t been to the SoFi stadium, I highly recommend it. It’s one of the wonders of the world. It’s just an unbelievable facility. But everyone had put a mask on going into the stadium or kind of had a mask on but if you’re eating or drinking, which almost everyone feigns that they did no one had a mask on. I call it the bib of compliance. You have this bib on, and no one cared. When everyone sat in their football seats, they didn’t care. I don’t know how many people were at that game. 50,000 People in LA which is about as regulated a territory within the US with respect to COVID. But almost no one had a mask on. So with respect to inflation, one thing I try not to do is listen to the people in Washington too much. Warren Buffett has an old saying about Wall Street where people show up in their Rolls Royces to get advice from people who ride the bus. Well, the people that I probably spend the least amount of time listening to are the people that are in the government that is going to tell us what’s going to happen with inflation, and what’s not going to happen with inflation. And maybe you should listen to Elon Musk or Jack Dorsey a little more carefully than you should be listening to the Fed. They have been consistently wrong on this inflation. Inflation is happening. Inflation is here. For now, I don’t see anything that’s going to make it back off. We have a whole host of issues. You have the well-reported supply chain issue, which is the goods. I live in Los Angeles. I’m in Hermosa Beach, literally, just to my left, you can see the ocean. And they’ve actually taken the container ships and pushed them 26 miles away to the other side of Catalina Island so that people in LA can’t see the 100 ships that are waiting to unload goods at the Port of Los Angeles. And that’s how our governments work. The reality is that goods from overseas, which are critical to so many businesses cannot unload here. But the government people want to keep it hidden from you. It’s like the Wizard of Oz, pay no attention to the man behind the curtain. But that ultimately will correct itself. What’s not going to change is the pandemic, and more importantly, the government actions as a result of the pandemic affect inflated wages pretty significantly. And I don’t see that as transitory. Let’s say you were someone working in a factory, or in a grocery store, in a restaurant, and you’re making pick the number, near minimum wage, so you’re making a call at $11, 12 an hour. And now you’re making 15, 16 17, 18 $20 an hour. It’s near impossible to go to that individual and say, well, you’re making $20 an hour, but we’re going to take you back down to 12.

Wages are very, very sticky. And you can argue, I think a politician will argue, well, that’s a good thing. And maybe it is but the wages are going up not because the economy is booming, but that a lot of actions have constrained the supply of labor. The price of labor has gone up because the supply is constrained. Now, why is it constrained? It’s constrained for a number of different reasons. One is that a significant number of people have left the workforce. And a significant number of people have rightly concluded that they’re better off not working and receiving meaningful benefits than making a couple of bucks extra by working full time. And so labor is in short supply. Literally today, Exxon announced a very large oil company that they’re going to significantly be increasing wages because they’re saying too many people defect. I think that the whole pandemic shutdown has made people rethink their priorities and what they do for a living. Maybe that’s not a bad thing. But what it’s done too is it’s made it easier for people to decide to leave the workforce. So we have all these things happening at once. We talked about inflation last time, I said last time, and I didn’t see that it was transitional. I’m still maintaining the same thing. I think inflation is going to continue. And you reference the 70s, I was in college in the 70s, started my career, I graduated college in 1980. So I’m not as old as you, but I’m older. And there are some flashbacks where, yes, the economy is coming back. But we had a blunt force shut down as a result of the pandemic, and it has to come back otherwise, you would have had just a worldwide depression. So that’s why I see where we are.

Barry Shore:

Let me unpack some of the things that you mentioned because I tried to prepare for this because I do value your insights, time, and what it is that you do as a wealth creator. And you don’t do that in a vacuum, you do it with other people, and therefore, you’re not riding a bus. We love bus riders to talk about wealth. Not that you’re riding in your Rolls Royce. But the point is that you’re working in tandem with teams of people who are concerned not just about today, but about the future. I’m going to make a mention of something, I wrote down here, and you said it wonderfully Peter. Inflation is, I wrote this, like COVID. If it gets loose it will dominate our politics, which I think is just beginning to happen. I want to share with people some numbers because numbers do speak a lot, as we say in Government speak, liars configure but figures can’t lie. Remember that one Peter?

Peter Nolan:

Yeah.

Barry Shore:

So when Jimmy Carter, by the way, 80% of the audience listening is under the age of 38 so they may have no idea what we’re talking about. And a lot of people listening from China, Pakistan, India, Africa all over the world, when a president named Jimmy Carter, and you can look him up, he took office I think in 76. So inflation was 4.8%. Now I want to make mention of that number again, 4.8%. Because according to government statistics, inflation today is 5.3%. So keep it in mind. It was 4.8% when Jimmy Carter took office, and today they say it’s 5.3%. The next year, when he took office in 76, inflation went to 6.8%. The following year it went to 9%. The following year it went to 11%. And when he exited the office, thank God in a landslide victory by Ronald Reagan inflation was 12%. If that was not bad enough because that’s when Peter says he came into the workforce he might who might remember this, Inflation was double digits. But even worse was that interest rates that banks were charging mortgages, people to borrow money exceeded 20%. I think the highest was 21.25. But it was at 20% in 1980. In other words, it was an untenable situation but it started at 4.8%. So you have this double whammy of inflation rising and not being cognizant of the bond market. The then government of Jimmy Carter put a kibosh on interest rates, and enabled them to realize because banks were afraid to lend money against rising inflation, they had to hedge themselves, or else when they go out of business it hurts everybody. As you just said, this is like COVID. When it gets out of hand. And then you have a wink and a nod, as you said, the bib of compliance it’s not going to stop this stagflation airy process that hurts everybody. I’ll make mention of something that my father taught me when I was younger. I think it was around the late 70s, maybe 75, 76 when he noticed these things because he was a businessman. He had retired, he’s done well. And he said inflation is a burden for everybody. It’s especially horrible. Horrible, he said for poor people, sick people, and the aging because of inflation.

Peter Nolan:

If you’re on a fixed income.

Barry Shore:

Yeah. And that’s what elderly people are. People over the age of 65, by and large, by the way, are on some sort of fixed income. I don’t care if it’s a larger pension or a smaller pension but it’s fixed. And by definition, as inflation rises your ability to buy goods and services declines. And if declines in double-digit proportions, even 10%, and it can go higher than that. Then every time you spend money you’re getting less in return. So it also is bad for poor people. People of means will always do well. But you’re running on a revolving cartwheel. So I want to go back and ask you another question in the same vein, and that is that we’ve heard this before Peter, you and I, and I am older than you. This time it’s different. Have you ever heard that before, Peter?

Peter Nolan:

Every time.

Barry Shore:

Thank you. So you as a wealth manager, because that’s really what you do. By the way, wealth is a nice acronym it stands for we all touch heaven. It doesn’t matter how you measure your wealth, whether you measure from your bank account, or you measure it because of your family or your health. We all touch heaven. What is it that you want to do with wealth? How do you manage your wealth? So, Peter, this time it’s different. What say you?

Peter Nolan:

Well, I would say to that, there’s an old saying that history doesn’t repeat but it rhymes. And so there are a lot of lessons from the past. If you go out and buy a 10-year treasury security, you lend the US government money for the next 10 years. Right now, at this very moment, the government will pay you 1.6% interest. Now, if you hold $1 today, and if inflation continues at 5%, let’s say, in a year that dollar’s worth 95 cents. So if you have the government willing to lend you money at 1.6%, but your purchasing power declines by 5%, you’re going to struggle, you’re losing money by investing. And it’s so interesting, given the inflation that we’re seeing how the treasury market has not yet responded. Real interest rates, if you will, are negative because of inflation. And so if you have your money invested in a bunch of safe bonds, you’ve lost money every year as the price of goods and services that you want to buy with that money increases more rapidly than the return on your money by a big measure, a wide gap. And by the way, anyone that’s gone out and bought gasoline, anyone that’s gone out and bought certain products in the grocery store knows that inflation is much higher in certain categories than the 5%. So I think that that’s the reason, two things if you look at what markets are doing well. Well, the stock market’s doing well, and why is the stock market doing well? Well, because there’s really no other place to chase return. And we are in recovery from the shutdown. And therefore, businesses are going to report increasing earnings and the market tries not to look at tomorrow but it tries to look at 6, 9, 12 months, even longer than that. So there’s an expectation that earnings will continue to rise. I expect that as well. And that’s one of the reasons the stock market continues to do well. And then interestingly enough cryptocurrencies have done really well because they’re viewed as a hedge on inflation. Because the government controls the supply of money. The government doesn’t control cryptocurrency. They want to though, and they probably will. But they don’t yet. And so a lot of people that are worried about the dollar, worried about government money, worried about the government printing more money are looking to crypto. That’s a whole separate discussion but to some degree that seems to make some sense. I’m not saying I don’t know what you’re buying when you’re buying Bitcoin or Aetherium or any of the cryptocurrencies. I fundamentally don’t know what you’re buying. You could argue, well, but you may not know what you’re buying when you buy dollars. And that’s true. The other interesting thing is, is if the classic hedge for inflation has been gold then gold has been kind of flat.

Barry Shore:

On that note, I want you to hold on to that note. I just wrote it down. We’re going to come right back after this brief message because we like capitalism, we have sponsors, and people pay to be on this show because they know you love what they do. And we’re going to be back right after this message, stay tuned, because there’s more Peter Nolan on the other side of these messages, which are great for you, and as is Peter Nolan. Amazing. Thank you, Peter. Be right back.

Advertisement:

Good day, everybody Barry Shore here. I’ve had the privilege of being involved in five startups in my career. And I can tell you, categorically, working at a startup is unimaginably hard. And I wish I had when I’m going to be talking to you about now. It’s called notion. Because having one spot to organize everything and work as a team makes it much easier. All your notes, documents, projects, processes, tasks. It’s great, don’t you wish you could have one way to pull them all together. Well, now you can. For startups, Notion can provide a full-on operating system for running every aspect of your company keeping everyone aligned as you grow fast and take on more. If you’re interested, and I urge you to become interested. If you want to find out more Notion is running a special offer just for startups. You’ll get up to $1,000 off Notion’s team plan by going to notion.com/startups to give you a sense of almost a year of free notion for a team of 10. Again, that’s notion.com/startups to receive up to $1,000 in free credit to use notion with your team. I urge you to do this now. That’s up to $1,000 value when you go to notion.com/startups Do it now. You’ll be glad you did. You’ll thank me, and I wish you great success.

Advertisement:

Imagine the kind of place you would want to shop for your favorite fur baby pet. Honest pets. co. Well, you found it honest pets.co, not.com, .co. This is your go-to spot for the best, the cleanest pet treats that exist anywhere on the planet. All of the brands go through a rigorous review to make sure they meet the high standards of cleanliness, health benefits, and naturalness. This site was started by a husband and wife team and it’s veteran-owned and that cares about pets, especially dogs and cats. And coming soon bird treats. These are very nice young people who really care about making a difference because a portion of the proceeds goes to support veteran organizations with a focus on service dogs. This is the place where you want to go, you want to tell your friends. This has the finest, yummiest, freshest, all-natural treats and stuff for your fur baby. So go there. Honestpets.co. Do it now.

Barry Shore:

Good day beautiful bound to the beloved immortal beings and good-looking people. Remember you’re good looking so always looking for and finding the good and we have good overflowing. A person named Peter Nolan, who is sharing with you transformative information. Peter already mentioned to us about the great reset, about wages going up and therefore not going to be coming back down again because you will not be able to entice people if you’re paying them now $20. And a couple of years should be working for $12. Unless of course there is a big downturn in the economy, which could happen. He’s also talking about the government is right now trying to keep things hidden, 100 container ships off the Port of Los Angeles. Just Los Angeles alone. And each container ship may have 1000 containers on it. And they’re talking about that supply chain is being choked. And we’re also talking about the ability of the government to pay you 1.6% interest on a 10-year note, yay, except inflation is 5.4% now. That’s just the past 12 months. So by definition, if you do that you lose money. Who wants to do that? So we are in a very interesting discussion here. We just left about the great question I was about to ask Peter. He’s talking about cryptocurrencies, which are truly crypto. Because who knows what’s going on versus gold, which is a traditional hedge, potentially, against inflation, because people understand it, know it, or they think they do. And it’s tangible and real. And yet, you see that it’s not the case today. Matter of fact, the famous Bitcoin has soared from $20,000 at a low about 8, 9 months ago to over 60,000 today. So it’s tripled in value. And yet, one never knows what it is, where it’s coming from, what you have, versus what somebody has. And I think part for me, Peter, is that the dynamics that are driving marketplaces today, you mentioned this our last time together, that there are millions of younger people, let’s say, under the age of 30, or under 35, who have some money, let’s not call them millionaires, let’s call them people with let’s say, from $1,000 to 10,000, who are becoming active in the marketplace, Allah, Robin Hood or crypto anything like that. And feeling at this time A, it’s different, even though they didn’t know about the other times, but feeling new vibrations out there that they are in control. And I think that’s a driver in the marketplace, personally. And now the people in the know, call it for want of a better term, who may not know anything, but they see a trend, and they want to be ahead of it are now jumping in. You have everybody from the Blackstone Group and people like that, banks and Goldman Sachs talking about crypto. But it is crypto. So let’s talk about crypto versus gold. If you were going to do something with some amount of money, let’s call it $20,000, would you consider either one of these as a hedge against inflation? Or would you simply not even consider either of them and do something else?

Peter Nolan:

Well, crypto is fun.

Barry Shore:

Can you turn up your volume just a little bit?

Peter Nolan:

Can you hear me now?

Barry Shore:

Yes, it’s better?

Peter Nolan:

Crypto is fun. It’s fun to invest in it, it’s for those that are very deep into online chat boards and the internet. It’s an exciting security to buy. Lately, it seems to only go up, but I cannot point to anything fundamental about crypto. So, you take the dollar, I can point to fundamentally it has the full faith and backing of the US government subject to manipulation. Gold, basically gold is probably one of the longest reserve currencies. Our dollar used to be convertible into gold, and then governments decided many, many years ago to uncouple from gold, which allowed governments to print money. Before, that’s why you had Fort Knox and all these other reserve banks that actually had gold reserves in their vault to back up the paper money that they were printing. Today. You, I think if you were a real crypto investor, you’d say “There’s no difference between what the government does to create currency versus what the crypto market does. One’s controlled by the government, the other is controlled by the crypto miners and the algorithm.” You’re not wrong, it’s just I have zero understanding of what the fundamental value of crypto should be. Should it be $62,000 or should it be 6? I don’t know. And therefore, I guess I’m the wrong generation, but I have a fundamental if I don’t understand it, I don’t do it. Now, I guess I think I understand what happens… I don’t necessarily understand all the moves the government is going to make with the dollar, I don’t necessarily understand where the price of gold is going to go, but I’m just more fundamentally comfortable with, for example, gold as a hedge against inflation than I am with crypto. I guess the answer is that I probably wouldn’t do either. I’m not buying gold, I’m not buying crypto right. What I look to do is by operating companies. You’ve described me as a wealth manager, and a wealth manager these days, stockbrokers if you will describe themselves as wealth managers. It’s a nicer term than a stockbroker. And what we are is we invest in companies, we own companies outright, we control companies outright, and what we’re doing is investing in areas within our companies to try to grow and create value for the shareholders, but also the employees and the management. So, the answer is if you’re going to invest in crypto, make sure you can lose every single penny that you put into it, make sure you’re perfectly comfortable with it, and have fun. It’s better than going to the horse track, but not a lot better because if you sit anyone down that is truly knowledgeable about crypto, no one can really explain to you the fundamental value, other than they believe in it more than the dollar, it is hidden from the government, and it also means that bad guys like to use crypto. Right now, in one of the latest tax bills that were being debated in Washington, the government wanted to have a report on every transaction in anyone’s bank account $600 and higher. And that’s not to get billionaires and millionaires, that’s to get the guy that is working in the cash economy. They don’t may not make very much money at all, that may be a $30,000 a year person, a minimum wage person, and the government wants to look at their tips to somehow start to tax it. And so, I think that crypto is a way to hide from the government in many ways, and not have the government looking into your affairs and keeping things out of sight. And for a lot of people that don’t trust the government that has a certain amount of appeal, but I’m of a different vintage, and I just don’t understand it, so I don’t do things I don’t understand.

Barry Shore:

Thank you for that. And by the same token, as you mentioned, yes, crypto will go from 60,000 to $6. There are at least half a dozen items that we can point to in history over the past couple 100 years, one of the great ones, his name was John Law. People should look this up because John Law was in France and he had the exclusive rights to trade in what France then controlled, they called it the Louisiana Territory. And at some point, he was issuing bonds that he was selling for opening up the Louisiana Territory and realizing all the potential there in terms of minerals and such, etc. And in one year, I think it went from January 1782 or something like that to December, the price of a bond went from let’s call it 100 whatever the currency was, livres in France, to 10,000. And people were going wild of course because you were making fortunes, but the only issue was the point that it was John lawmaking… he was issuing paper.

Peter Nolan:

Look at this. I don’t know if you can read this.

Barry Shore:

Yes, we love this. Please tell everybody what this is again.

Peter Nolan:

This is a Zimbabwe 100 trillion dollar bill. So, what happens in a country like Zimbabwe is they get hooked on printing money to solve their budgetary problems. And so, what happens in places like Zimbabwe becomes completely overzealous, and they print so much money that it’s not even worth the paper. I have carried all this, several 100 trillion dollar bills, and it’s not even worth the paper. And so, that’s one of the things that’s frightening about monetary policy. And could that happen in the US? Of course, it could. I don’t think it will. But certainly, politicians love to spend money, and one of the ways they can spend money without raising taxes is to print money. They give it a name like quantitative easing and other names that may be the public doesn’t necessarily grasp right away, instead of saying, “Well, we’re just going to print a bunch of money and buy stuff and therefore, put that money into circulation,” which is what they do. And when you have that coupled with the very fundamental things that are going on out there in the economy that are causing prices to go up naturally, it can really affect the value of your investments, and so you really want to look at investments that protect you. A lot of people, for example, you’ve seen the price of oil go up of course and you see that at the gas pump, you see the price of food go up, inflation and retail, those are areas where you can hedge yourself against what’s going on in this inflationary cycle. There will be a period of time where it will level off, but I think the economy will get challenged. And a lot is going on right now that, you just can’t raise all these taxes, and spend all this money and not have it impact people’s investments.

Barry Shore:

And I think that’s coupled with something that I’m going to say without maligning everybody, but I think it’s true. It’s certainly been true for me. I’m 72. chronologically, it’s been true for me since I was 12 years old, I first entered the workforce as an entrepreneur shoveling snow in Boston, Massachusetts, and leveraging myself and a few of my friends to make money when it snowed and school was called off. And that is that I think the financial literacy level of people in the United States of America is abysmally low. I think if we did a survey, we asked 10,000 people what is the rule of 72? I think that 99.2% of people would look at us with querulous eyes and say, “I have no idea what you’re talking about.” And if you don’t even know the rule of 72, which is that money doubles depending on the interest rate every 12 years. Let’s say 6%, you made 6% on your money, or if you had inflation at 6%, it would double the price in 12 years, that’s the rule of 72. That number, 6X12 is 72. The financial literacy is so low that the government can do things. And again, obscure as you mentioned, either by hiding ships by Catalina Island so there are out of view and or doing things like… I wrote this down because I wanted to make sure that I was expressing myself correctly, and I went to a number of different sources, and I’m going to tell you what I wrote down Peter and you can just comment either yes or no, that’d be fine. Right now, we’re facing at the moment, forget Mr. Biden’s policies and what he wants to have happened with additional trillions, but right now, the amount of money, the trillions that are in the system are such that there is an $8.2 trillion overflow in the economy. That’s the numbers that are given. And what I wrote down for myself was that most spending by the government is not about fixing any problem. It’s about satisfying constituencies who want power over other fellow citizens. And unfortunately, the terrible example right now that’s even being tossed around is the idea of, well, we’re going to go and tax those billionaires, a billionaire tax, and we’re going to tax unrealized capital gains. If there was ever… I wouldn’t even call it an idea, if there was ever lunacy that was proposed as potential policy, it’s probably that. Because when you even posit that you’re going tax unrealized gains, it won’t stop with billionaires because the government is addicted, they are junkies.

Peter Nolan:

It’s a gateway tax. In many ways, it’s brilliant politically. Let’s tax Elon Musk and Jeff Bezos because they’re ungodly rich. And you add together a few different high-end billionaires and they have as much money in theory as the bottom 40% of the population in the US combined. That’s the argument, that they have so much money, it’s immoral, it’s wrong, let’s confiscate it.

Barry Shore:

Remember, that’s one of the four horsemen, inflation, deflation, confiscation.

Peter Nolan:

Right. And so, a lot of people won’t like someone like me because why defend those guys? But the problem you have is twofold. One is that you historically don’t get taxed until you sell something and have a gain. Because they may have a whole bunch of stock in a public company that they have not sold, that they may have owned since the day they created the company, it’s not as though they have the cash to pay that tax right away. It’s a really bad precedent. It’s a slippery slope because then you go, “Well, what about this guy’s farm or what about this house?” Housing prices, for example, I live in California and housing prices are up significantly, so if you have a house and let’s say it was worth a million dollars, that’s like a starter home.

Barry Shore:

That’s a starter home in Los Angeles, that’s a good one.

Peter Nolan:

And the price goes up by 30%, which it kind of has, then you have a $300,000 increase in price, and why don’t we just tax them? Why don’t we have a wealth tax on that, in addition to the property taxes you’re already paying? And you can do that on so many different things, and it’s going to cause conduct which is not in our interest? If you look at for example, how did we get out of the pandemic? We didn’t get out of the pandemic because of the government. We really got out of the pandemic, because of the private sector. It was really Maderna, and Pfizer, and Johnson and Johnson, these evil drug companies created products that are a miracle. They should be receiving the Nobel Prize. They’re not. And yes, the government did something which I applauded, they basically said to these drug companies, “We’re going to take away the drug development risk, and we’re going to give you money no matter what happens so you have no incentive to stop developing these drugs.” And that’s what saved us. It’s not the mask, it’s not the shutdowns, and it’s not anything else that’s happened. It is basically the technological prowess of these drug companies. And so, I look at how are we going to solve climate issues? How are we going to solve all the issues of the world? It’s really going to come from the private sector. And I’m a big private-sector guy so I’m going to apologize… it’s not really going to come from Washington, and so what you don’t want to do is punish. We’ve had breakthrough successes in so many industries which have made our lives better, and which have made the world a better place, which has reduced, for example, carbon in the United States has been reduced, yet there’s a desire to confiscate and go after these folks. And mark my words, if they get the wealth tax through, and they’re saying it’s just going affect a few 100 billionaires, it isn’t going to stop there. That’s like you’ve gone into the drug den, and you’re going to take your first shot of heroin, and a couple of things are going happen. One is, you’re not going to get as much heroin as you thought you were going to get because these guys aren’t fools, and they’re going to figure out ways. And then you’re going to want more, and you’re going to want more, and you’re going to want more, and then it’ll just expand. I just think a country from a policy point of view, these guys are national treasures. Now, I don’t know if they’re good people or bad people, I’m just saying the businesses. Amazon is a national treasure, Tesla is a national treasure. These companies that have been developed and created this wealth, there’s a reason. They’ve done things that have made people’s life better and advanced us at this point in history, and that is the beauty of capitalism. Capitalism at the end of the day, and the reason I’m a capitalist is capitalism is a fundamentally virtuous activity because it is the best allocator of Economic effort ever devised. And the opposite of Capitalism is what you see in places like Cuba and North Korea, Venezuela, the Soviet Union, where some central governmental planner decides how assets should be allocated. And I would much rather deal with the marketplace than some bureaucrat figuring out how assets should be allocated. It’s not perfect, it’s brutal, they call it basically creative destruction because competitors are waking up trying to destroy each other every day, but that makes your product better. And so, you know, I’m an enormous fan of it. I am an unapologetic capitalist.

Barry Shore:

On that note, there’s a couple of things I’d like to do because our time is so short because you’re so good. I want to make people aware of a couple of things I think you might find also quite amazing Peter. Again, we’re talking about… do you remember the 70’s? In 1977 our federal debt was 34% of our Gross Domestic Product, GDP. 2021, our federal debt is 125%. In other words, yes, we spend more than we bring in and it’s not changing is no. There is no get your arms around and let’s see what we can do to make us more solvent. 125% of GDP today, with all these new bills that the Biden administration is saying that it’s in our best interest to do this. It seems the opposite, that’s number one. Number two, and this is where it gets, I believe, truly, potentially dangerous vis-à-vis the Democratic Republic. In 1977 12% of Americans, 12% of Americans got direct government aid in any form. Welfare and such like that, 12%. 2021, 51% of Americans get direct government aid, and that’s not including before pandemic spending. Now, all the trillions are in the pipeline, that’s not including all of that. So, you have more than half of the country getting direct aid from a government that is as the title of the great book by Mr. Hayek, The Road to Serfdom. When you literally put people in economic slavery, I’m being graphic here, then you control what they think and what will happen because they’re dependent on you. As you mentioned, heroin is a dependency, getting money from the government is a dependency. So, when that which is giving you what you think you need and want, it’s the temptation to vote that way to make sure that the others who have so much more… Now, by the way, when you mentioned that particular names, we know all the names, and they are not all men, by the way, there are a number of women who are billionaires as well, but the point is not one of them, not one of them used a gun, or a missile, or any kind of criminal behavior to build and create the entities that have not just enriched them, but as a Bezos said so wonderfully one time when they asked him, look how much money… he said, “Yeah, and look how many millionaires I’ve made, who was making $50,000, a year 10 years ago because they got stock options.” And Elon Musk, you mentioned about Tesla, he laughs. I heard him on a private chat, it must have about three or four years ago, he was laughing out loud. He says, “Everybody thinks I’m a genius. Do you know what I did? All I did was I brought back the electric car, which preceded the internal combustion engine. I said, duh, why can’t we do that? And you all think I’m a genius.” And he was laughing.

Peter Nolan:

Well, he made it work right? There have been other attempts.

Barry Shore:

Right, there were many attempts, but he made it work. But the point that you’re mentioning and it’s so wonderful. That’s the creative destruction of the marketplace. There were others try and get, but the ones that emerged are… Facebook had 20 different competitors before it became Facebook. So, you’re right, we’re not talking about the people, good, bad, or indifferent. The Marketplace, if it’s given its opportunity, people will select and choose, who knows? You get Trump with a new social media, who knows what Facebook… Can you imagine Facebook not here in 10 years? It’s unthinkable, but who knows.

Peter Nolan:

Myspace was Facebook before there was Facebook. Just Myspace now. And that’s the creative destruction. And my comments have nothing to do with the morality or non-morality of any of those people. It’s just a general comment, I would rather have the marketplace allowed to function on their own, and I don’t care if someone… I think it’s a bad thing to care if someone is successful, you should really focus on yourself, and what you can do to advance your lot in life. And don’t look at Bezos, and his spaceflight and everything else. And all the money he has, all the value, and his stuck. My attitude is, so what. He created a business that we all now use, and we like and there are hundreds, if not thousands of people that are in college, Silicon Valley, Massachusetts, or even LA, that are trying to figure out how to beat him at his own game. And I think that is a great thing. And having the United States be the country where these businesses grow and flourish is an enormous asset to this country and the advancement of this country. And once you get to the point where you say, well, you’ve been too successful so I’m going to take it from you. Because for no other reason than you just been successful. I think that is a very frightening prospect. And that’s what happened in places like the Soviet Union, and Venezuela. And one of the big differences, by the way, is that when you look at corruption, if you watch a movie, the bad guy is almost always a guy and a business person. That’s the villain you see out of Hollywood these days. But if you look at who the bad guys are throughout history, they are the corrupt leaders of governments. I’m not saying every business person is a saint, and I’m not saying that every politician or government leader is a bad person. But I think that there’s this over vilification of capitalism, and I find it, quite honestly very frightening. And living in California, by the way, it’s even worse. Tesla’s moving out of California, Oracle moved out of California. Many people I know are moving out of California because it is a state that punishes financial success. How do they do that? They have the highest tax rates in the country, and they may go even higher. We may have a California wealth tax, who knows? In the meantime, we can’t even unload a ship here.

Barry Shore:

By the way, I think it’s not a maybe, Peter. I think it’s a given. It’s the nature of the beast, I call it the politics of envy. And when you stir up people to envy other people rather than emulate and say, hey, I could do that. I could open up something, I have an idea, I have a dream, and I can make it happen because I live in the United States of America. I live in California, anything is possible, and everything is possible because I’m here in America. We don’t want to allow the four horsemen of the economic apocalypse to enter our mindset, heart, and that of our fellow citizens. We want to look at our fellow citizens as builders, doers, creators, beneficiaries, not as people taking away from me because the pie is so enormous. There’s no such thing as a small pie.

Peter Nolan:

If a politician says it’s a zero-sum game, they’re a fool. It’s not a zero-sum game. Through work, innovation, technology, and all these other things you can lift all the boats. And that’s what’s happened in this country. And going back to your financial illiteracy. There’s a belief that’s been developed over the years that people that have been successful financially must have done something evil. They must be bad. They must be punished, and what they have must be confiscated. And taxation is a form of group confiscation, except for the portion of it. But if you look at it, there’s this increasing enthusiasm to take more, because there is a wider gulf between the bottom strata of the economy and the top strata of the economy. And I attribute that mostly to technology. That technology has made it easier for someone to create a Facebook, Instagram, Tesla, or Amazon, and therefore to reap unusually high gains. And for the person that doesn’t have those skills, it’s just not going to happen the same way. And I think that it’s an interesting issue. There’s still plenty of opportunity for everyone in this country. And if someone’s willing to not live on the government dole, not become addicted to free money from the government, and get out and try to create businesses and work, there’s a way to build tremendous wealth as long as you’re willing to work hard at it. And I don’t want to see incentives that are set up to discourage that.

Barry Shore:

I’m going to use the last part of that we’re going to talk about courage. And thank you for your courageous stand, Peter Nolan. Again, everything you want to know about Peter and there’s lots to know. Share this, and listen again. Share this with at least five people, it means a million and a half people will be learning and watching this. Just go to my website, www.whatawonderfulworld.barryshore.com because you can’t get this kind of information on the nightly news or even in some sort of fake news upside channel. This comes from somebody who gets his hands dirty in the most wonderful way by turning over the soil, and plants. And he’s a farmer in reality. He plants his ideas, and he reaps the benefit of them because as he said, he runs operating businesses. And he thinks in long term, and he really wants everyone to be successful because it’s not a zero-sum game. It is a big plus game. If you’re in America, you can do it. Now the good news is you might even be able to do it in other places in the world because you work with and for American companies. So America’s tentacles because of technology, touch almost everybody in the world. So get involved everybody because Peter Nolan is leading the band, and he’s great… 76 trombones lead the marching band. And that’s him. I’m not going to give you a hug Peter in front of these hundreds of thousands of people but I will ask you two quick questions. One is where you come back again?

Peter Nolan:

Barry, I always respond to your call.

Barry Shore:

I am humbled and honored. Thank you. And I’m going to ask you in 80 seconds, it might be unfair, but let’s try and do it in 80 seconds. What is your most fervent desire?

Peter Nolan:

Well, it’s health, happiness, and my family.

Barry Shore:

Now what he just wished for himself, I’m saying this for him, is what he wishes for every human being that’s listening. See, that’s the genius of the system that we wish for ourselves and we wish it for everybody. I told you listen to this show you’re on the joy of living, you’ll be happier, healthier, and wealthier, and we proved it today. We live by the three fundamentals. The number one fundamental is your life has purpose. Number two, go mad and go make a difference. Number three, unlock the power in the secrets of everyday words and terms. www, what a wonderful world smile, seeing miracles in life every day as my eight-year-old niece says, seeing miracles in everyday life. And create the kind of world you want to live in causing rethinking, enabling all to excel. Rethinking, be independent. You don’t have to depend upon the government. Be yourself, become your best self. You make the world a better place. And say thank you three times a day. Consciously, conscientiously, you’ll do something good for yourself, your family, your friends, and all living beings around the world. Remember thank you. Thanks. [Unintelligible: 1:09:35] to harmonize and network kindness. Use four-letter words. Remember, we live in a positive, purposeful, powerful, pleasant world. So our four-letter words are live, love, hope, grow, free, give, pray, play, swim, life. Living inspirationally for eternity and telling the world to FU. Capital N, capital N, because that is beginning to conversate. What do you say? Yeah, I heard on Barry Shore’s the Joy of Living wants to teach the world to F U, capital N capital N. So again, our prayer from Peter and Barry is to go forth live exuberantly, spread the seeds of joy, happiness, peace, and love. Go mad. Go make a difference.

Automated Recording

Thank you for listening to this episode of the Joy of Living Podcast. Now that’s another step towards your healthier, happier, and wealthier life. Never hesitate to do good in the world, no matter what the situation. Join us for another upbeat discussion next time at barryshore.com. And be sure to leave a rating and subscribe to the show to get more conversations like this. And remember to share it with your family and friends too. See you on the next episode.

About Peter Nolan

Peter Nolan founded Nolan Capital, Inc. in 2014 as the holding company for his family office to make long term investments in growth oriented companies.

Prior to founding Nolan Capital, Inc., Peter joined Leonard Green & Partners (“LGP”) as Managing Partner in 1997 along with Jon Sokoloff and John Danhakl. Under their leadership, the firm completed approximately 100 principal investments and grew Assets Under Management from $500 million in 1997 to over $38 billion today. In 2019, Leonard Green raised approximately $15 billion for its most recent funds. Peter transitioned to his current role as Senior Advisor to Leonard Green & Partners in 2014.

Learn more about Leslie:

[bctt tweet=”There’s an old saying that history doesn’t repeat but it rhymes. ” username=”ambassador4joy”]