Share This Episode

Navigating Economic Challenges: Insights and Perspectives

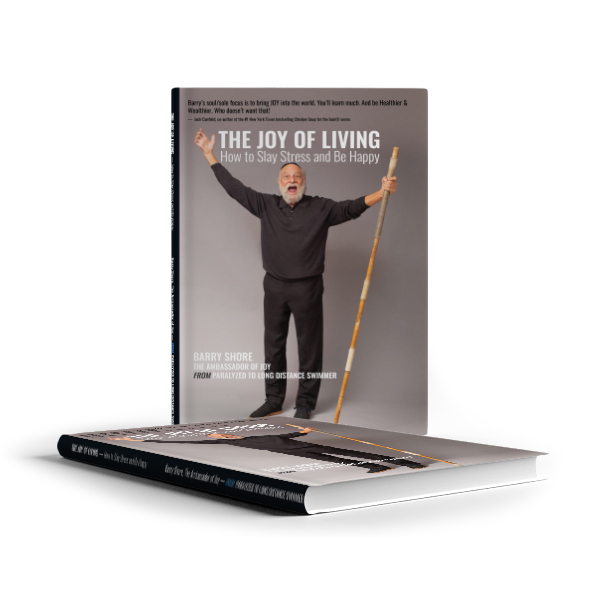

Join host Barry Shore in this insightful episode of “The Joy of Living” as he engages in a stimulating conversation with guest Peter Nolan. Together, they explore the latest economic policies, inflation concerns, the role of central planning versus market forces, the potential impact of a wealth tax, and the ongoing challenges faced by businesses in today’s world.

In their discussion on economic policies, Barry reflects on his initial negative outlook on the economy, only to find that the U.S. economy has proven resilient against various challenges. Despite this resilience, they both acknowledge that the economy is not performing at its peak, with significant layoffs affecting numerous companies and the full impact of rising interest rates yet to be felt. They also touch upon the decline in real GNP or GDP growth and the possibility of a recession in the future.

Tune in to this thought-provoking episode of “The Joy of Living” to gain valuable insights into the economy, inflation, wealth taxation, and the business landscape, all while uncovering the true joys and challenges of living in today’s world.

Listen Here (click here to watch episode)

Show Notes:

[10.57] Economic Policies

In this segment, we discuss the current state of the economy and its challenges.

- Initially, I held a negative view on the economy, but it turns out that I was mistaken.

- So far, the U.S. economy has managed to withstand various challenges.

- However, it is important to note that the economy is not performing exceptionally well.

- Many companies are resorting to significant layoffs.

- While unemployment rates remain low, there is a notable increase in the number of people being laid off.

- Despite this, hiring new employees remains a difficult task.

- The impact of rising interest rates has not fully permeated the economy yet.

- The growth of real GNP or GDP is experiencing a decline.

- Although we are not currently in a recession, the possibility of one occurring is quite high.

[16.09] Inflation

In this segment, we discuss the topic of inflation and its effects on various aspects of daily life.

- The cost of food is not increasing and, in fact, it is decreasing.

- The size of beef cattle in the U.S. remains the same as it was in 1960.

- Most beef is raised on grass until approximately six months prior to slaughter.

- Due to drought conditions, ranchers have reduced the size of their herds.

- The value of cattle today is only 76 percent of what it used to be.

- People are cutting back on expenses and opting for more affordable options. There has been a decline in real wages.

- It doesn’t matter how many dollars you have; due to inflation, their purchasing power decreases.

- As a result, people are expressing dissatisfaction with the state of the economy.

[21.03] Central Planning VS Market

In this segment, we explore the concept of a central planning versus a market-driven approach, and how it affects various aspects of the economy.

- The price of eggs has increased.

- There has been a significant increase in demand for baby chicks at farm supply businesses.

- The implementation of wage and price controls by President Nixon occurred in the past.

- Currently, in the marketplace, we observe a trend of people opting for more affordable options.

- Certain restaurants are notably expensive due to higher costs related to inputs and labor.

- It came as a surprise to me that gas stoves have been deemed unfavorable, but this knowledge has been apparent only in the last eight months.

- Individuals in positions of power within the government hold strong beliefs about how things should be done.

- The government, for example, insists that the only acceptable way to cook pizza is using an electric heating device.

- However, the majority of pizzas, over 90 percent, are cooked using gas, despite the government’s desire to eliminate gas usage.

- Most of the franchise owners in California over the past 35 years were minority people.

[40.01] Wealth Tax

In this segment, we discuss the concept of a wealth tax and its potential implications.

- There have been discussions in California about implementing a wealth tax.

- A wealth tax is a tax imposed on an individual’s total assets.

- If you own assets such as a farm, you would need to determine its value and pay taxes based on that assessment.

- Other countries that have attempted to implement a wealth tax have experienced significant failures in generating revenue.

- In fact, countries that have previously had a wealth tax have ultimately abandoned it.

- Despite half a million people leaving my state, we still face a housing crisis.

- If a wealth tax were to be imposed, the outmigration of individuals would likely accelerate even further.

- France, for example, witnessed a substantial number of people leaving the country when they introduced the wealth tax.

- It is important to note that a very small percentage of the population bears the majority of the tax burden.

[47.12] Land of Opportunities

In this segment, we delve into the current state of the business landscape and the challenges it faces.

- There is still a significant amount of difficulty and challenges to be dealt with.

- Various factors influence the performance of businesses, particularly in the real estate sector.

- The foremost factor that impacts real estate is the interest rate.

- Occupancy rates in central city offices are relatively low.

- Many individuals carry variable debt, which adds to cautiousness in urban areas.

- People are being more careful with their spending and not investing as much in growth.

- Consumers have been adversely affected by inflation.

- However, businesses are unable to fully pass on the price increases to customers, resulting in a mismatch with inflation.

- Many individuals in the political sphere mistakenly believe that running a business is easy and akin to having a magical monopoly.

- In reality, the truth is quite the opposite. Running a business entails numerous challenges and complexities.

What’s your most fervent desire?

I’m very concerned about what’s going on in the world. My desire is for world peace.

Important Links:

About Peter Nolan

Peter Nolan founded Nolan Capital, Inc. in 2014 as the holding company for his family office to make long term investments in growth oriented companies.

Prior to founding Nolan Capital, Inc., Peter joined Leonard Green & Partners (“LGP”) as Managing Partner in 1997 along with Jon Sokoloff and John Danhakl. Under their leadership, the firm completed approximately 100 principal investments and grew Assets Under Management from $500 million in 1997 to over $38 billion today. In 2019, Leonard Green raised approximately $15 billion for its most recent funds. Peter transitioned to his current role as Senior Advisor to Leonard Green & Partners in 2014.

[bctt tweet=”France, for example, witnessed a substantial number of people leaving the country when they introduced the wealth tax.” username=”ambassador4joy”]

THIS SHOW BROUGHT TO YOU BY ORGANIFI

use code LIVING for 20% off your next order